How much is stamp duty

in NSW?

How much is stamp duty in NSW?

What is Stamp Duty?

Stamp duty is a tax that is charged on various types of transactions, including property purchases, in the Australian state of New South Wales (NSW). In the case of property purchases, the stamp duty is payable by the buyer and is calculated based on the purchase price or market value of the property, whichever is higher.

The revenue generated from stamp duty goes towards funding various government programs and services such as healthcare, education, and infrastructure. The amount of stamp duty payable can vary depending on factors such as the value of the property, whether it is a first home purchase, and whether the buyer is eligible for any concessions or exemptions.

First Home Buyers Scheme NSW

In NSW, Australia, first home buyers may be eligible for a stamp duty concession or exemption.

Under the First Home Buyers Assistance Scheme, eligible first home buyers can receive a full exemption from stamp duty for new homes valued up to $800,000 and a concession for new homes valued between $800,000 and $1 million. For existing homes, eligible first home buyers can receive a stamp duty concession for homes valued up to $650,000 and a concession for homes valued between $650,000 and $800,000.

To be eligible for the scheme, the purchaser(s) must be at least 18 years of age and must be purchasing the property as their principal place of residence. They must also meet certain income and property value thresholds and have never owned a property before.

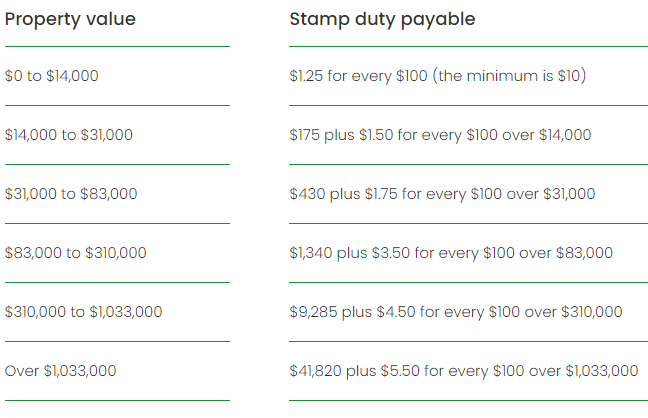

How much stamp duty will I pay in NSW?

In New South Wales (NSW), Australia, the stamp duty payable on property purchases can vary depending on the value of the property and the buyer’s eligibility for concessions or exemptions. For first home buyers, there is a scheme called the First Home Buyers Assistance Scheme which provides a full exemption from stamp duty for new homes valued up to $800,000 and a concession for new homes valued between $800,000 and $1 million. For existing homes, eligible first home buyers can receive a stamp duty concession for homes valued up to $650,000 and a concession for homes valued between $650,000 and $800,000.

Property value

$0 to $14,000

$14,000 to $31,000

$31,000 to $83,000

$83,000 to $310,000

$310,000 to $1,033,000

Over $1,033,000

Stamp duty payable

$1.25 for every $100 (the minimum is $10)

$175 plus $1.50 for every $100 over $14,000

$430 plus $1.75 for every $100 over $31,000

$1,340 plus $3.50 for every $100 over $83,000

$9,285 plus $4.50 for every $100 over $310,000

$41,820 plus $5.50 for every $100 over $1,033,000

NSW Stamp Duty Calculator

Stamp duty is a significant expense when buying a property, and often people don’t factor it into the initial budget. By using a stamp duty calculator, you are able to get a quick estimate of how much might be payable in stamp duty. This can help you plan and budget more effectively. Additionally, by having a clear idea of how much stamp duty you might be paying, you can ensure that they have enough funds available to cover this cost, as stamp duty is typically due within 3 months of signing a contract. Should you not pay your stamp duty on time, it may accrue interest charges.